Charitable Contribution Receipt Template

Moreover you can only issue a donation receipt under the name of the individual who made the donation. And you must provide a bank record or a payroll-deduction record to claim the tax deduction.

Free Donation Receipt Template 501 C 3 Word Pdf Eforms

The written acknowledgment required to substantiate a charitable contribution of 250 or more must contain the following information.

. Theres no time like the present to perfect your donation letter and stand out among the crowd. Your church donation letters can double as email communications too. Free to Use for Any Charitable Gift.

All charitable contributions need receipts that accurately reflect the value of the contribution. A donor is responsible for valuing the donated items and its important not to abuse or overvalue such items in the event of a tax audit. A Goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on an individuals taxes.

However not all members of your congregation will respond to direct mail donation letters. The receipt must also be having the proper information on it. Send Email Donation Letters Too.

Donations to churches often go towards general operating expenses mission work building costs and improvements and to help those in need. The document is customized to contain all the details of the people associated with the donation the reason of donating and the amount of donation. Updated June 03 2022.

If a donor is claiming over 5000 in contribution value there is a section labeled Donee Acknowledgement in Section B Part IV of Internal Revenue Service IRS Form 8283 that must be completed. If you donate but do not obtain and keep a receipt you cannot claim the donation. Noncash Charitable Contributions applies to deduction claims totaling more than 500 for all contributed items.

Charitable Donation Request Guidelines and Templates. Once you write a solid donation letter template you can build on it for campaigns and years to come. There may be a special appeal that the church is having to fund a specific project as.

Church Phone Number - Church Treasurer or the designated person in charge of tracking contributions phone number is preferred due to any questions the members might. You should include this information to make your document useful and official. Public charities and private foundations formed in the United States are eligible to receive tax-deductible charitable contributions.

In most years as long as you itemize your deductions you can generally claim 100 percent of your church donations as a deduction. Just having the receipt is not enough. The organization must be exempt at the time of the contribution in order for the contribution to be deductible for the donor.

For example if a donor gives a charity 100 and receives a concert ticket valued at 40 the. They are usually a good list of what you paid. A general rule is that only 501c3 tax-exempt organizations ie.

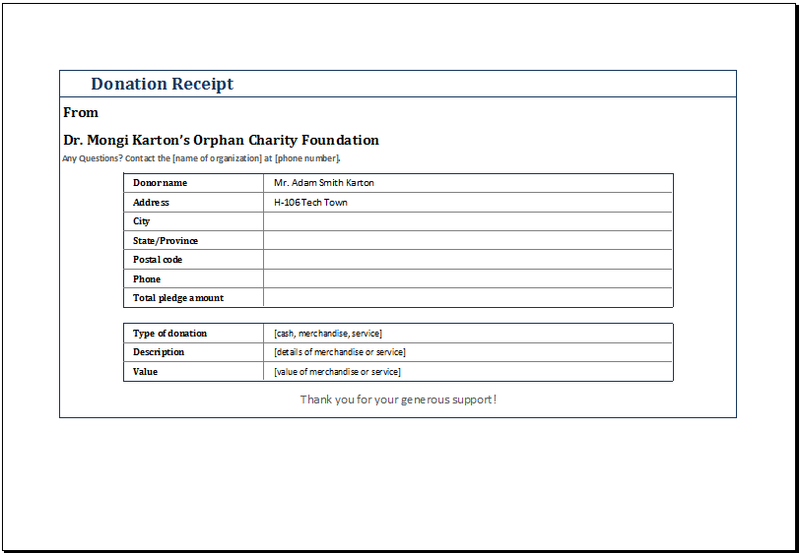

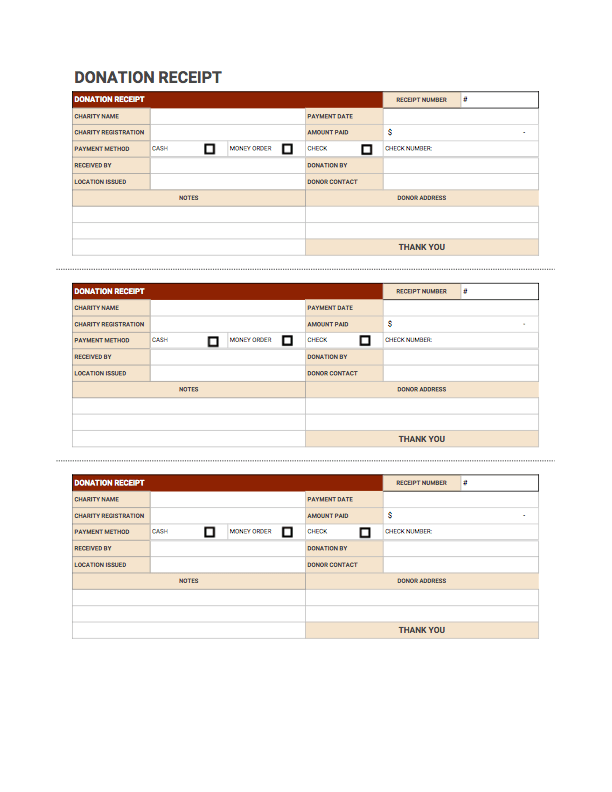

Description but not value of non-cash contribution. A donation receipt template should comply with particular requirements when it comes to the information it contains. You can get the most from this if you segment your church members into groups and send them to the most appropriate groups for specific donation campaigns.

Vendors and suppliers may have duplicate records. Cash donations of 250 or more. Your annual contribution or donation letter template letter receipt etc must include.

The requirement is that donors must keep records showing the date of their donations either through cancelled checks bank statements or credit card statements. Church Name and Address- Include your Church name and address in the letterhead or somewhere in the top of the letter. If you are non-profit and do not keep proper records you can be fined 1000 per donation and 5000 per charity event.

Check out Bloomerangs annual fundraising appeal letter writing infographic to get a better sense of structuring your appeal. If your church operates solely for religious and educational purposes your donation will qualify for the tax deduction. A Pledge Form Template is a pre-formatted document that is used to donate funds.

Unfortunately many donors dont keep this information. If claiming a deduction for a charitable donation without a receipt you can only include cash donations not property donations of less than 250. When you prepare your federal tax return the IRS allows you to deduct the donations you make to churches.

These documents are generally used by non-profit organizations and groups that donate money to different people. Statement that no goods or services were provided by the organization if that is the case. Name of the organization.

5 Donation Receipt Templates. You need a receipt and other proof for both of these. The contribution date technically isnt required to be on the donor receipt.

A 501c3 donation receipt is required to be completed by charitable organizations when receiving gifts in a value of 250 or moreIts utilized by an individual that has donated cash or payment personal property or a vehicle and seeking to claim the donation as a tax deduction. They may also be a good substitute if you dont have a receipt. Updated June 03 2022.

Date of the Contribution. A quid pro quo contribution is a payment made to a charity by a donor partly as a contribution and partly for goods or services provided to the donor by the charity. Amount of cash contribution.

This list of some common items offers an idea of what your donated clothing and household goods are worth as suggested in the Salvation Armys valuation guide.

Required Information On Tax Donation Receipts

30 Non Profit Donation Receipt Templates Pdf Word Printabletemplates

Donation Receipt Free Downloadable Templates Invoice Simple

Free 10 Charity Donation Receipt Samples Templates In Pdf

Free Donation Receipt Templates Silent Partner Software

Free Donation Receipt Templates Samples Word Pdf Eforms

Free Donation Receipt Templates Silent Partner Software

Donation Receipt Template Donation Letter Receipt Template Donation Form