Vat Invoice

Accurate description of goods and or services indicating. Search again Start a topic.

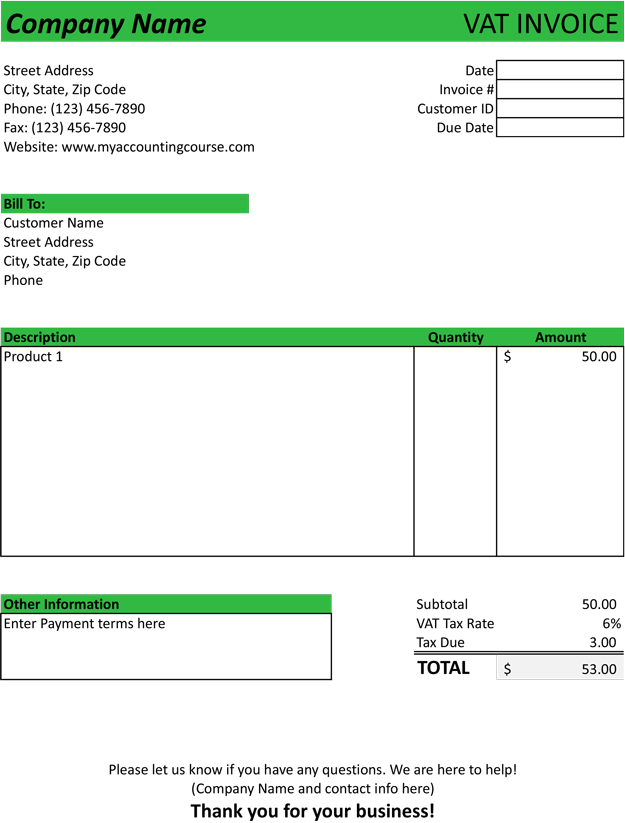

Vat Invoice Template Sample Form Free Download Pdf Excel Word

I have a strange situation that occurred with a supply invoice.

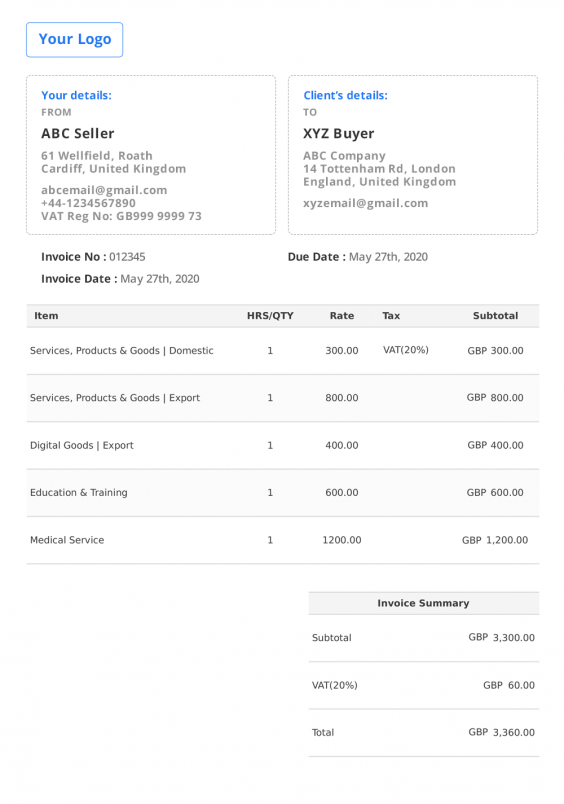

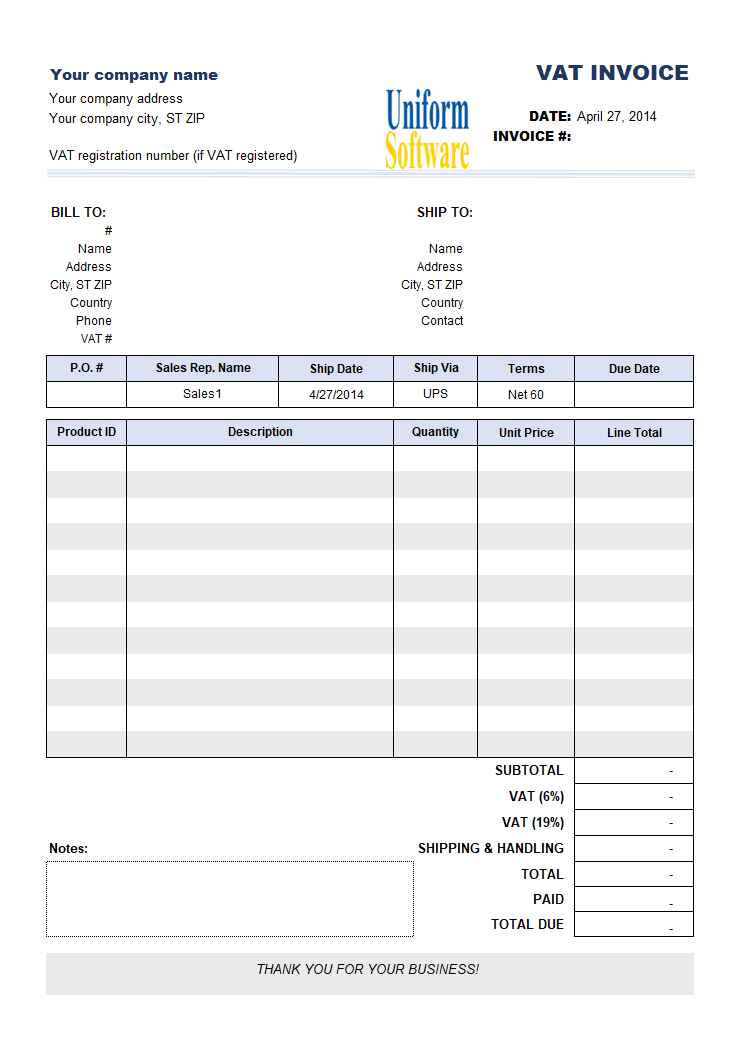

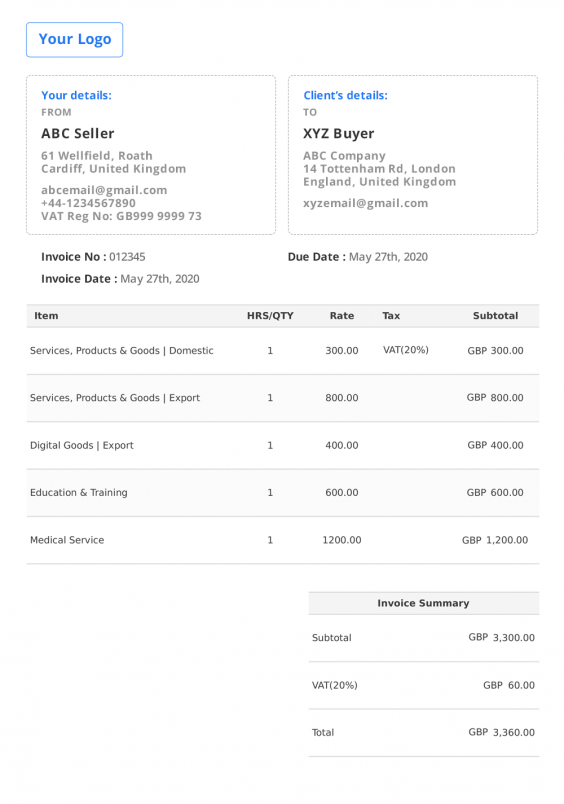

. A modified invoice is very similar to a full invoice except that for each item charged at standard or reduced rate. Total Before VAT - 300 VAT 20 - 60 Total Invoice Before CIS - 360 The Total amount Payable to you - 320 CIS is only deducted from the Labour element of your invoice and does not affect the VAT amount the customer has to pay. Template 1 Left Logo Template 2 Centered Logo Template 3 Right Logo.

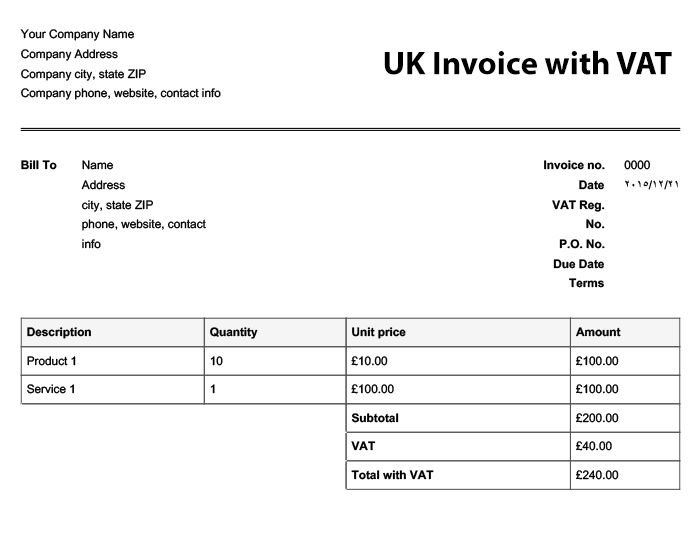

The VAT rate for the UK currently stands at 20 per cent this was changed from 175 per cent on the 4th of January 2011. Show the VAT information on your invoice - invoices must include your VAT number and display the VAT separately show the transaction in your VAT account - a summary of your VAT record the amount on. A VAT invoice is an accounting document issued by a business that outlines the details of the products or services sold that are subject to a value-added tax.

If you need one for your device plan these have to be requested monthly and will be posted out to you. They do not confirm actual VAT paid. An invoice is required for VAT purposes under EU rules in.

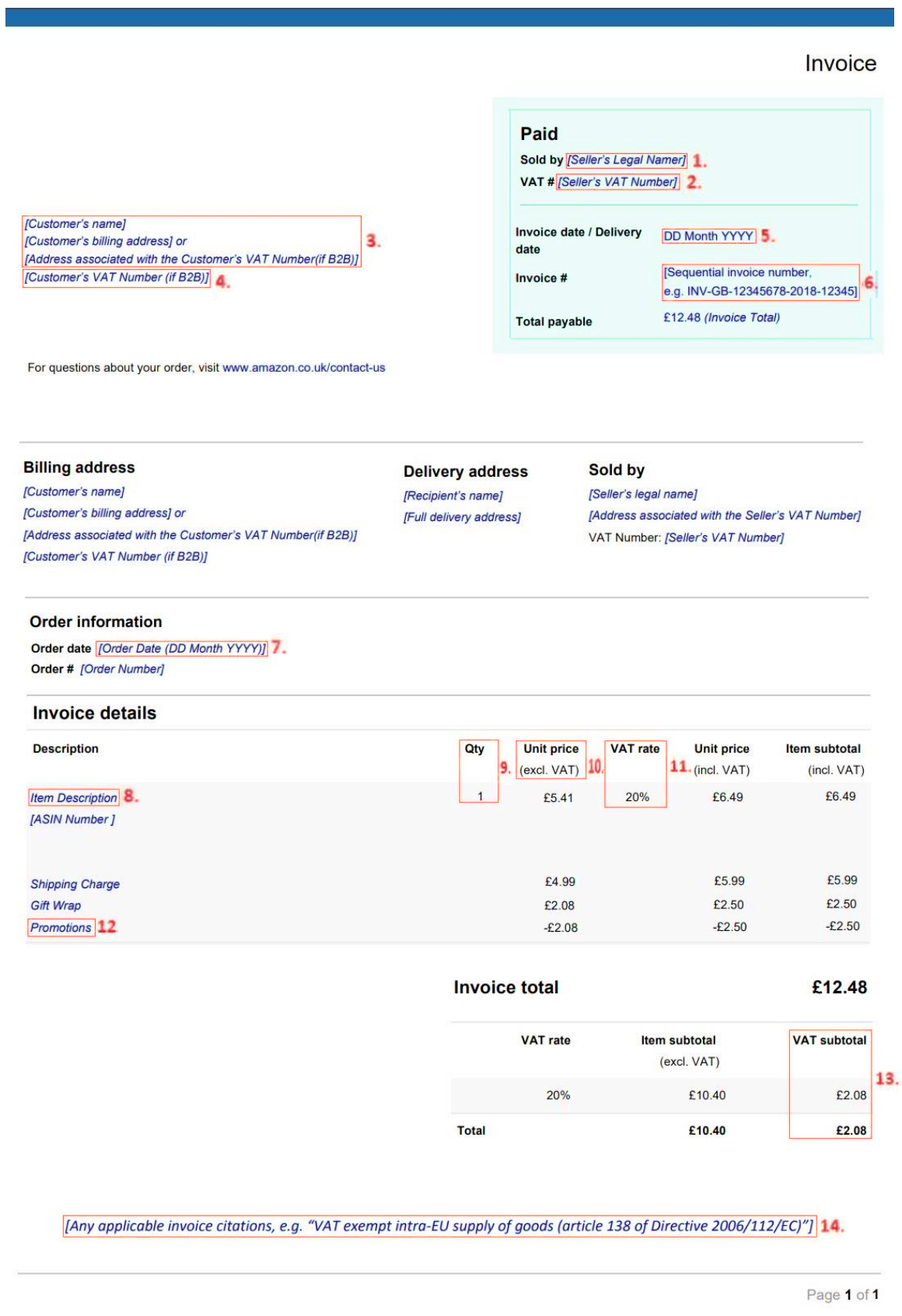

When is an invoice compulsory. The modified invoice must show. VAT on an invoice based on two items.

If your Order Was Sold and Dispatched by Amazon You can obtain a printable version of your order summary in Your Account. Reserve a room today. Just like every other regular sales invoice a VAT invoice is issued to inform clients about the amount of money they owe for products provided and to establish an obligation for that payment.

Simplified VAT invoices are exactly what you would expect - a simplified version of a full VAT invoice. Ad See How Your Business Is Doing In Less Than 30 Seconds. If the payments are going to be made regularly you can issue a VAT invoice at the beginning of any period of up to a year for all the payments due in that period as long as theres more than 1.

Free UK Invoice Template with VAT. FreshBooks Provides Easy-To-Use Double-Entry Accounting Tools To Run Your Small Business. A full VAT invoice is a document that complies with all the requirements of VAT Regulations 1995 regulation 14 1 as amended by SI 20852007.

Characteristics of a VAT invoice. Quotes are estimated prices for goods or services. Remember dont discount your labour element as your invoice must show the original cost before any CIS is deducted.

Built-In OCR Scanning For Fast Processing. VAT-inclusive value of each standard-rated or reduced rate item. Ad The Only AP Automation Solution To Streamline The Entire Invoice-To-Reconciliation.

VAT Invoices Information for obtaining a VAT invoice for your order varies depending on the seller and the entity that raised the invoice. Name address and where the recipient is a vendor the recipients VAT registration number. Simplified VAT invoices can only be issued for sales up to 250.

Get updates when invoices are opened and automate payment reminders. Most business-to-business B2B supplies certain business-to-consumer B2C transactions There may also be specific national rules on transactions requiring an invoice. A VAT invoice is used when selling goods with an added VAT tax.

Add Discounts add more fields if applicable and print save as PDF or email the invoice to your client Preview Print. Ad Create and send custom invoices with Xero invoicing software. Value of those items excluding VAT.

Use this invoice when requesting payment for products or services that have an added VAT tax. Vat invoices are only available on your airtime tariff and you need to call customer service on 202 not live chat to get them enabled. The standard rate of VAT was temporarily reduced to 15 per cent on 1 December 2008.

Ad Ensure Accuracy Prove Compliance Prepare Quick Easy To Understand Financial Reports. A VAT invoice also known as a tax invoice is a specific type of invoice that needs to be used if you or your customer are registered for VAT. What is not a VAT invoice.

Get updates when invoices are opened and automate payment reminders. A VAT invoice is just the term for an invoice which contains some information required by the VAT rules. Contains the words Tax Invoice VAT Invoice or Invoice.

Invoices should be made out to the company claiming the VAT. One of these options may help you find the answers you need. Ad The Only AP Automation Solution To Streamline The Entire Invoice-To-Reconciliation.

FreshBooks Provides Easy-To-Use Double-Entry Accounting Tools To Run Your Small Business. VAT payable on those items. Ad Create and send custom invoices with Xero invoicing software.

A Ltd cannot reclaim the VAT on an invoice to B Ltd. Posted 24 minutes ago by Theochari Alex. A VAT invoice is a commercial document that lays out all of the details of goods and services sold that are subject to a value-added tax.

If the sale is above 250 then you must issue a full or modified VAT invoice. A simplified VAT invoice will include all prices as VAT inclusive rather than exclusive. EE are able to supply VAT invoices to personal customers you need to provide your company VAT number I have had this confirmed to me at senior level within EE.

The other had a gift card on it that was free for purchasing the laptop this was zero rated on the invoice. I received two invoices one had a laptop on it and charged at standard rate VAT. Built-In OCR Scanning For Fast Processing.

For most countries outside the United States a VAT tax is a percentage of the value of a product or service when it is transferred or purchased. Please click here for VAT Rate information Visit Technojobs for the best UK IT Jobs. They are a commitment to a price not a confirmation of sale.

Ad See How Your Business Is Doing In Less Than 30 Seconds. Under European Union tax laws a VAT invoice must be issued within 15 days of the end of the month in which the products or services were provided. The amount payable including VAT is shown.

Report post Message 8 of 8 1259 Views Reply 0 Cant find what youre looking for. Most commercial invoices will already meet the requirements. Make an Invoice Now Table of Contents.

Locate hotels and book in a visit to over 500 affordable Travelodges throughout the UK. Add or edit the Taxes from the Set Taxes button. Ad Ensure Accuracy Prove Compliance Prepare Quick Easy To Understand Financial Reports.

This was put back to 175 on the 20th January 2010. As from 8 January 2016 the following information must be reflected on a tax invoice for it to be considered valid. I have no affiliation whatsoever with O2 or any subsidiary companies.

Vat Invoice Requirements Tide Business

A Value Added Tax Vat Invoice Geekseller Support

Vat Invoicing Sample With 2 Separate Rates

Managing Invoices Whilst Waiting For Vat Registration Inniaccounts

Uk Invoice Template Free Invoice Generator

Free Uk Invoice Template With Vat Online Invoices

How To Get Nelio Content Vat Invoices

What Is A Vat Invoice Charging Value Added Tax To Eu Clients

Template Of The Invoice Of The Vat Payer Tax Document Fakturaonline Rs